The 2-Minute Rule for Hsmb Advisory Llc

Table of Contents5 Simple Techniques For Hsmb Advisory LlcAbout Hsmb Advisory LlcAbout Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You Get ThisHsmb Advisory Llc Fundamentals ExplainedSome Known Incorrect Statements About Hsmb Advisory Llc Not known Details About Hsmb Advisory Llc

Also realize that some plans can be costly, and having particular health problems when you use can increase the costs you're asked to pay. Insurance Advise. You will require to make certain that you can afford the costs as you will need to devote to making these repayments if you desire your life cover to continue to be in placeIf you feel life insurance policy could be beneficial for you, our collaboration with LifeSearch allows you to get a quote from a number of suppliers in double double-quick time. There are various types of life insurance policy that aim to meet various protection demands, consisting of degree term, decreasing term and joint life cover.

More About Hsmb Advisory Llc

Life insurance policy supplies 5 monetary advantages for you and your household (St Petersburg, FL Health Insurance). The major advantage of including life insurance to your monetary strategy is that if you pass away, your heirs receive a swelling amount, tax-free payment from the policy. They can use this money to pay your last expenditures and to replace your revenue

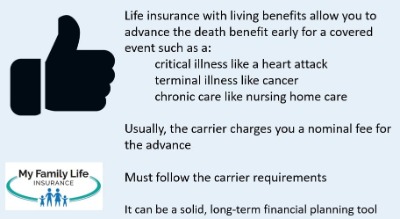

Some plans pay out if you create a chronic/terminal disease and some give financial savings you can use to sustain your retirement. In this article, find out about the different benefits of life insurance and why it might be a great concept to buy it. Life insurance uses benefits while you're still to life and when you die.

The 3-Minute Rule for Hsmb Advisory Llc

If you have a plan (or plans) of that size, individuals who depend on your revenue will certainly still have cash to cover their recurring living expenditures. Beneficiaries can use plan benefits to cover essential everyday expenditures like rent or home loan settlements, energy costs, and grocery stores. Ordinary annual expenses for homes in 2022 were $72,967, according to the Bureau of Labor Statistics.

The Of Hsmb Advisory Llc

Additionally, the cash worth of entire life insurance policy expands tax-deferred. As the cash money worth develops up over time, you can use it to cover costs, such as getting a cars and truck or making a down repayment on a home.

If you choose to borrow versus your cash money worth, the loan is not subject to earnings tax as long as the policy is not surrendered. The insurance policy company, however, will certainly bill rate of interest on the loan quantity the original source till you pay it back (https://dribbble.com/hsmbadvisory/about). Insurance coverage business have differing rate of interest on these finances

Get This Report about Hsmb Advisory Llc

For instance, 8 out of 10 Millennials overestimated the price of life insurance in a 2022 research. In reality, the typical expense is closer to $200 a year. If you think spending in life insurance policy may be a smart financial move for you and your family, take into consideration speaking with a financial expert to embrace it into your monetary plan.

The 5 main types of life insurance coverage are term life, entire life, global life, variable life, and last expense coverage, also known as burial insurance policy. Entire life begins out setting you back much more, yet can last your whole life if you keep paying the premiums.

See This Report about Hsmb Advisory Llc

It can repay your debts and medical bills. Life insurance policy can additionally cover your mortgage and offer money for your family to keep paying their bills. If you have family depending upon your revenue, you likely need life insurance policy to support them after you pass away. Stay-at-home moms and dads and company proprietors additionally commonly require life insurance coverage.

Generally, there are two sorts of life insurance policy plans - either term or long-term plans or some combination of the 2. Life insurance providers supply different kinds of term strategies and conventional life policies in addition to "interest delicate" products which have ended up being more common because the 1980's.

Term insurance coverage provides protection for a specific time period. This period might be as short as one year or give protection for a particular variety of years such as 5, 10, 20 years or to a defined age such as 80 or in many cases up to the earliest age in the life insurance death tables.

Some Known Details About Hsmb Advisory Llc

Currently term insurance coverage rates are really affordable and amongst the most affordable historically experienced. It should be kept in mind that it is a widely held idea that term insurance policy is the least pricey pure life insurance policy coverage readily available. One needs to review the policy terms carefully to decide which term life alternatives are suitable to fulfill your certain situations.

With each new term the premium is increased. The right to renew the plan without evidence of insurability is a crucial advantage to you. Or else, the danger you take is that your health may wear away and you might be not able to get a policy at the same rates or even in all, leaving you and your beneficiaries without insurance coverage.

Comments on “Hsmb Advisory Llc Things To Know Before You Get This”